The end of the year will be here before you know it, but there’s still time to take steps that may help reduce your 2014 tax liability. Here are some ideas to consider.

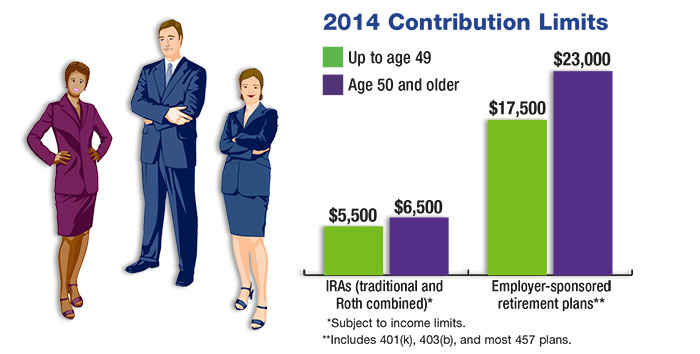

Increase tax-advantaged retirement contributions. If you participate in a workplace retirement plan, the deadline to make 2014 contributions is December 31. Your employer’s plan may allow you to increase or decrease contributions at any time. IRA contributions for 2014 can be made up to the April 15, 2015, tax filing deadline. (See chart for retirement plan contribution limits.) A SEP IRA could give you a deduction if you are self employed in SC, NC, FL or GA of up to $52,000 in 2014.

Consider deferring income. Depending on your situation, consider deferring income (including investment income) to next year. Because the tax rates on income, dividends, and capital gains are permanent, it should be easier to strategize from one year to the next. Keep in mind that if your modified adjusted gross income exceeds $200,000 ($250,000 if filing jointly), you might be affected by the 3.8% unearned income tax on net investment income.

Contribute to charity. Contributions of cash and noncash items to qualified charitable organizations are generally deductible if you itemize deductions. Be sure to keep all receipts and other documents required by the IRS.

Make January payments early. If you itemize, paying your January mortgage payment this year could increase your interest deduction. If possible, consider making other payments before the end of the year, such as business expenses if you are self-employed.

Use your FSA. Although this probably won’t change your tax liability, be sure to use funds from health-care and dependent-care flexible spending accounts (FSAs) by December 31. Depending on how they’re set up, some plans may allow a carryover or grace period to use any leftover funds.

Even if you began tax planning earlier in the year, you may have a clearer picture of your financial situation now, so it might be worthwhile to reexamine your strategy. Before you take any specific action, be sure to consult with your tax professional.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.