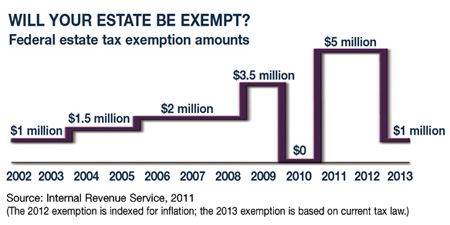

The federal estate tax was repealed in 2010, then reinstated by the 2010 Tax Relief Act with new provisions for 2011 and 2012. These provisions include a higher exemption amount and a lower tax rate that could ease or eliminate the tax burden on many estates.

The federal estate tax was repealed in 2010, then reinstated by the 2010 Tax Relief Act with new provisions for 2011 and 2012. These provisions include a higher exemption amount and a lower tax rate that could ease or eliminate the tax burden on many estates.

Although the reinstated estate tax may not affect you now, it is scheduled to become more aggressive in 2013 and beyond, potentially affecting many families who might not be considered wealthy.

What’s New?

For estates left behind in 2011 and 2012, assets exceeding a $5 million exemption will be taxed at 35%, the lowest top tax rate in 70 years. A new portability provision allows surviving spouses to use the unused portion of a deceased spouse’s exemption, provided he or she makes the appropriate declaration on the estate tax return. Thus, married couples may be able to pool their exemptions to shield up to $10 million from federal estate taxes. The law also brings back the ability to “step up” the basis of assets to the fair market value on the deceased owner’s date of death.

Options for 2010

Estates of 2010 decedents can choose the 0% federal estate tax that was in effect that year, when the modified carryover basis rules were also in effect. (Under these rules, heirs must use the lesser of the decedent’s basis or the fair market value on the date of the owner’s death when calculating capital gains.) Alternatively, decedent estates can choose the reinstated estate tax and the new provisions. Their choice may affect capital gains taxes on some estate assets.

What’s Next?

Without further legislation, the federal estate tax will revert to a $1 million exemption and a top tax rate of 55% in 2013. The portability provision is also scheduled to expire after 2012. These changes could subject many more estates to the tax than under current law.

No one can anticipate what will happen in the future, but it’s important to be aware of the temporary estate tax provisions and the potential for change in 2013. Before you take any specific action, be sure to consult with an experienced estate, legal, and/or tax professional.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2011 Emerald Connect, Inc.