Raising taxes is one of many ideas that have been proposed to help reduce mounting federal budget deficits. Yet some taxpayers are already facing the prospect of higher taxes as a result of health-reform legislation passed in 2009.

Raising taxes is one of many ideas that have been proposed to help reduce mounting federal budget deficits. Yet some taxpayers are already facing the prospect of higher taxes as a result of health-reform legislation passed in 2009.

In 2013, single filers with modified adjusted gross incomes exceeding $200,000 ($250,000 for joint filers) will be subject to a 3.8%

Medicare unearned income tax on net investment income. The Medicare payroll tax will increase by 0.9% on wages exceeding these thresholds.

Investing in Infrastructure

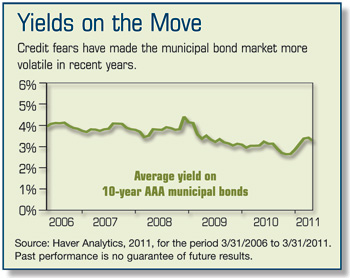

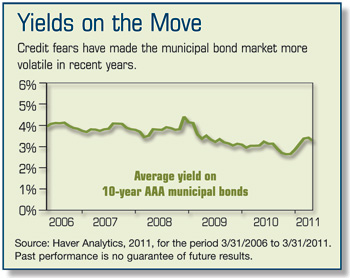

State and local governments sell bonds to finance public-works projects such as roads, sewers, schools, and stadiums. Because

government entities have the power to raise taxes and fees to pay the interest, municipal bonds are generally considered higher-quality assets. However, they typically pay less interest than taxable debt.

On the plus side, municipal bond income is generally exempt from federal taxes and may not trigger the Medicare tax mentioned earlier. The interest on a bond issued outside the state in which you reside could be subject to state and local taxes, and some municipal bond interest could be subject to the federal

alternative minimum tax.

Tax-Free Fund Options

Tax-exempt mutual funds earn interest from their underlying state and local bonds, so they share the same federal income tax exemption. However, if you sell a municipal bond or tax-exempt fund at a profit, you could incur

capital gains taxes.

The tax benefits associated with these lower-yielding mutual funds may also make them more suitable for taxable accounts, as opposed to qualified

retirement plans and IRAs that allow for tax-deferred growth until the assets are withdrawn. Withdrawals from tax-deferred plans prior to age 59½ may be subject to a 10% federal income tax penalty.

The return and principal value of bonds and mutual fund shares fluctuate with changes in market conditions. When redeemed, they may be worth more or less than their original cost. Bond funds are subject to the same inflation, interest-rate, and credit risks associated with their underlying bonds. As interest rates rise, bond prices typically fall, which can adversely affect a bond fund’s performance.

High Earners May Net More

Investors in the top tax brackets may find that the lower tax-free yields from muni bonds and tax-exempt funds are worth more to them than the after-tax yield from

taxable bond investments. For example, a 3%

tax-free yield is equivalent to a 4.62% taxable yield for an investor in the 35% federal income tax bracket.

Municipal bonds and tax-exempt funds can be a key component of the portfolios of investors with high incomes and/or a relatively low tolerance for risk. If you fall into these categories, you may want to learn more about tax-efficient investment opportunities that could be appropriate for your personal situation.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an

independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2011 Emerald Connect, Inc.

Click here for more Newsletters. Thank you.

Raising taxes is one of many ideas that have been proposed to help reduce mounting federal budget deficits. Yet some taxpayers are already facing the prospect of higher taxes as a result of health-reform legislation passed in 2009.

Raising taxes is one of many ideas that have been proposed to help reduce mounting federal budget deficits. Yet some taxpayers are already facing the prospect of higher taxes as a result of health-reform legislation passed in 2009.