Safe Harbor 401(k) Plans May Help Owners and Employees Save More

With standard 401(k) plans, the amount that a company’s owners or highly compensated employees can contribute is often restricted by how much other employees contribute to the plan, making such plans a less effective savings vehicle for many small businesses. However, with the more flexible safe harbor option, owners may be able to make larger contributions for themselves (as employee and employer) in exchange for making tax-deductible contributions or “matches” for employees.

With standard 401(k) plans, the amount that a company’s owners or highly compensated employees can contribute is often restricted by how much other employees contribute to the plan, making such plans a less effective savings vehicle for many small businesses. However, with the more flexible safe harbor option, owners may be able to make larger contributions for themselves (as employee and employer) in exchange for making tax-deductible contributions or “matches” for employees.

In addition, the annual IRS non-dis-crimination testing that normally applies to standard 401(k) plans is eliminated from safe harbor plans, which typically makes them easier and less expensive for small businesses to maintain.

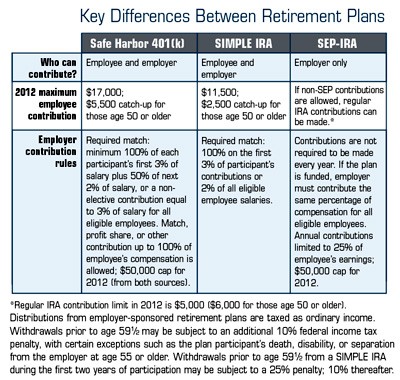

To help shelter more of your income from taxes in Charleston SC, Miami FL, Charlotte NC and Atlanta GA, and possibly help your employees do the same, compare the benefits and limitations of safe harbor 401(k) plans to other retirement plans to determine which one could best meet your company’s needs.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2012 Emerald.

Click here for more Newsletters. Thank you.