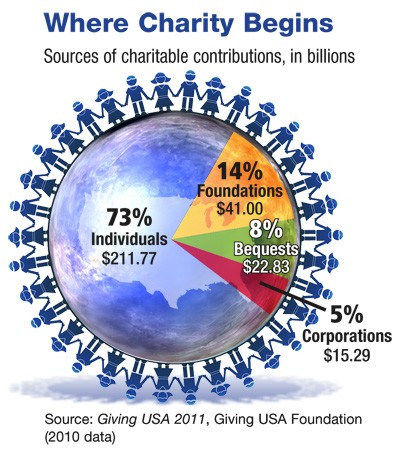

A recent study using data from 136 countries suggests that spending money for the benefit of others promotes a feeling of happiness in the giver.1 This may not be surprising to the many people who donate to charity. Almost three-fourths of charitable giving in the United States comes from individuals (see chart).

Charitable contributions could also help ease your tax burden; therefore, it’s important to keep appropriate records and follow IRS guidelines. Here are some tips that could help you derive tax benefits as you provide help to others.

Qualified organization. Make sure that the charity is a qualified charitable organization under IRS rules. Not all charitable organizations are able to use all possible gifts, so it’s a good idea to check before you give. The type of organization you select can also affect the tax benefits you receive.

Qualified organization. Make sure that the charity is a qualified charitable organization under IRS rules. Not all charitable organizations are able to use all possible gifts, so it’s a good idea to check before you give. The type of organization you select can also affect the tax benefits you receive.

Records. Keep written records for all cash and noncash contributions. Cash contributions of $250 or more require a specific written statement from the organization or an appropriate bank or payroll deduction record. Documentation for noncash contributions depends on the amount of the deduction, with progressively more rigorous requirements at thresholds of $250, $500, $5,000, and $500,000.2

Contributions from which you benefit. If you receive a benefit as part of your contribution, such as a “gift” or a dinner, you must deduct the fair market value of the benefit from your charitable contribution.

Volunteering. Although you cannot deduct the value of your time or services, you can deduct unreimbursed out-of-pocket expenses for the benefit of a charitable organization, such as supplies for a fundraiser. You may also deduct vehicle expenses directly related to serving a charitable organization, using actual expenses or a 2012 rate of 14¢ per mile. You need specific documentation for unreimbursed expenses of $250 or more.3

IRS rules for charitable contributions can be complex, and these are only basic guidelines. Before you take any specific action, be sure to consult with your tax professional.

1) National Bureau of Economic Research, 2010

2–3) Internal Revenue Service, 2012

2–3) Internal Revenue Service, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.