You may be familiar with the most common types of investment companies — mutual funds and exchange-traded funds — but how much do you know about a third type: unit investment trusts (UITs)?

You may be familiar with the most common types of investment companies — mutual funds and exchange-traded funds — but how much do you know about a third type: unit investment trusts (UITs)?

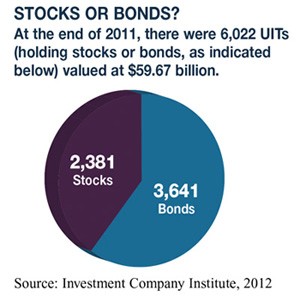

A UIT purchases a portfolio of stocks or bonds. The portfolio is divided into shares called “units” and sold to individual investors. Once the investments are selected, the portfolio is generally designed to be fixed, with a specified termination date.

Therefore, a UIT may offer a relatively clear picture of its holdings throughout the life of the investment. However, UITs are not managed, so the underlying investments usually are not adjusted in response to market conditions.

All UIT dividend and interest payments are distributed as they are received and generally can be reinvested. Distributions are not guaranteed. As securities within the portfolio mature, the principal amount is returned to investors.

Most UITs issue only a specific, fixed number of units, but some sponsors maintain a secondary market where units can be bought and sold. When a UIT reaches its termination date, the trust is dissolved and proceeds are paid to investors. The sponsor may offer investors the opportunity to roll over the proceeds to a new UIT on a tax-deferred or non–tax-deferred basis depending on the structure.

Most UITs issue only a specific, fixed number of units, but some sponsors maintain a secondary market where units can be bought and sold. When a UIT reaches its termination date, the trust is dissolved and proceeds are paid to investors. The sponsor may offer investors the opportunity to roll over the proceeds to a new UIT on a tax-deferred or non–tax-deferred basis depending on the structure.

There are risks associated with investing in UITs, including the potential for a downturn in the financial condition of the issuers of the underlying securities. The return and principal value of UITs fluctuate with changes in market conditions. Units, when sold, may be worth more or less than their original cost.

If you’re interested in adding a unit investment trust to your portfolio in Charleston SC, Atlanta GA, Charlotte NC or Miami FL, be sure that you understand the underlying investments, the termination date, and other UIT provisions.

UITs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.