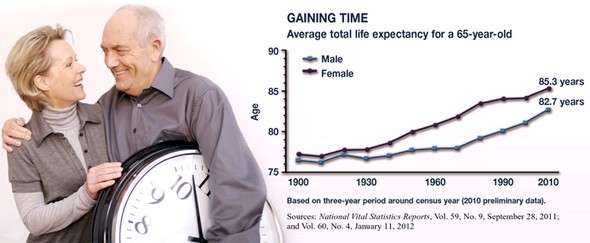

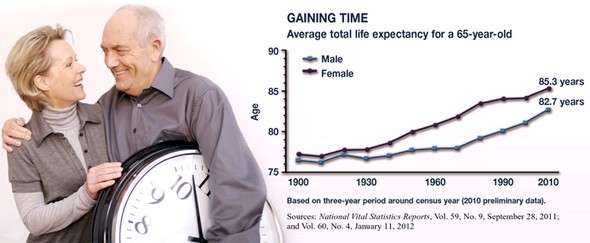

The number of Americans aged 90 and older almost tripled between 1980 and 2010 and is expected to quadruple by 2050.1 This trend reflects the fact that life spans have been increasing steadily since 1900 (see chart). Of course, life expectancies represent the average number of years someone of a certain age is expected to live. If you live in Charleston SC, Miami FL, Charlotte NC or Atlanta GA, you might live longer.

Even though a longer life span is a positive trend, many people may find it challenging to make their savings last throughout a long

retirement. In one survey of retirees and near-retirees, almost half of the participants expressed the fear of

outliving their savings.

2

Longevity Insurance

If you would like a steady income that could last throughout retirement, you might consider purchasing longevity insurance, a

fixed annuity that provides a

guaranteed monthly income starting sometime in the future. An annuity purchased today might begin providing a steady income stream in 10, 20, or 30 years (depending on the contract) and could continue for as long as you live.

Because the annuity is deferred, premiums would typically be lower than they would be with an immediate annuity. And the longer the annuity is deferred, the higher the monthly income could be.

An Integrated Strategy

Without a source of

guaranteed income, it might be difficult to estimate how much to withdraw each month from your

retirement savings. Withdraw too much and you risk running out of money in your lifetime. Withdraw too little and you may live on a more limited budget than necessary, missing out on some of the experiences you have looked forward to enjoying in retirement.

Longevity insurance might help you feel more comfortable making withdrawals during the earlier phase of retirement, knowing that a guaranteed income stream would be available when you reach a specific age. For example, a 65-year-old who purchases longevity insurance that would begin at age 80 might draw down more retirement assets over the 15-year period before the annuity income starts than he or she would have been able to do otherwise.

Annuity payouts could also be structured to continue throughout the lifetime of a second individual, providing income for a surviving spouse (as long as the contract remains in force). This may be especially

important for women, who often are younger than their spouses and typically live longer than men.

3–4 In fact, more than 84% of women who live to age 90 and older are widows.

5

Premiums for a fixed annuity can be paid in a lump sum or a series of payments. If the insured dies before annuity payouts begin, the insurer will generally keep the premiums that were paid. You should be aware that funds invested in a fixed annuity do not have the opportunity to pursue potentially higher

returns in the financial markets. And inflation could reduce the future purchasing power of the annuity payouts.

A fixed annuity is an insurance-based contract. Any guarantees are contingent on the claims-paying ability of the issuing insurance company. Generally, annuities have contract limitations, fees, and expenses. Most annuities have

surrender charges that are assessed during the early years of the contract if the annuity is surrendered. Withdrawals of annuity earnings are taxed as ordinary income. Early

withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty.

1, 3, 5) U.S. Census Bureau, 2011

2) usnews.com, May 25, 2011

4) National Vital Statistics Reports, Vol. 59, No. 9, September 28, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an

independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.

Click

here for more Newsletters. Thank you.