The American Taxpayer Relief Act of 2012, approved by Congress on January 1, 2013, left current income tax rates in place for most households. However, it raised taxes on high earners for the first time in about 20 years.1 If a deal had not been struck, federal income taxes were scheduled to return to higher pre-2001 tax-law levels for all taxpayers in 2013.

The temporarily reduced 4.2% Social Security payroll tax (implemented as an economic stimulus) reverted back to 6.2%. Thus, most workers will see a 2% decrease in their take-home pay.

The legislation addressed a wide range of federal tax policies, including taxes on earned income, investments, and estates. Other pressing negotiations on pending automatic budget cuts and alternative measures to help reduce the national debt still need to be negotiated in the months to come.

If you are curious about how the tax changes could affect your finances, you may be interested in some of the following details.

Rates Permanently Defined

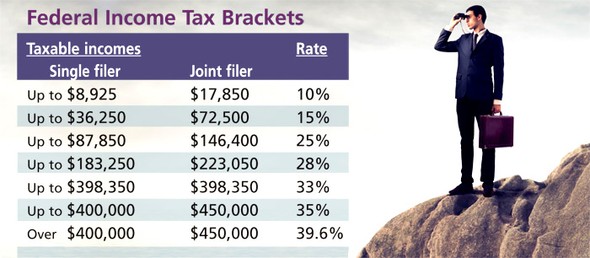

The federal income tax brackets effective in 2012 were made permanent for all taxable income up to $400,000 ($450,000 for married joint filers). Income above that threshold is taxed at a 39.6% rate. (The tax bracket dollar thresholds are indexed annually for inflation.)

High-income taxpayers may also be subject to two reinstated provisions that could affect their personal exemptions and itemized deductions.

- Single filers will lose 2% of their personal exemptions for every $2,500 of adjusted gross income (AGI) over $250,000; the threshold is $300,000 for married joint filers.

- The “Pease” provision limits itemized deductions (including charitable donations and mortgage interest) for high earners. Taxpayers must reduce itemized deductions by 3% of the amount that exceeds the above thresholds.

There are some limits to this rule. For example, itemized deductions cannot be reduced by more than 80% of the otherwise allowable amounts.

A 20% tax rate on long-term capital gains and qualified dividends was added by the act that affects only taxpayers in the new 39.6% tax bracket. All other taxpayers are subject to a maximum 15% rate, except those in the 10% and 15% federal income tax brackets, who still pay zero taxes on long-term capital gains and qualified dividends.

AMT Fixed

The alternative minimum tax (AMT) was designed years ago to help limit the effect of tax advantages that enabled some affluent households to pay little or no income taxes. The AMT has a different set of calculations than the regular tax. Because the original tax law did not take inflation into account, lawmakers have used annual “patches” to keep the AMT from hitting more middle-income households.

The 2012 tax law has permanently and retroactively adjusted the AMT with new exemption levels that will be indexed annually for inflation. The IRS estimates that this fix will save around 30 million middle-income taxpayers from being subject to the AMT on returns filed for the 2012 tax year.2

Credits Extended

The Child Tax Credit and Earned Income Tax Credit, which are generally claimed by workers who earn up to $50,000 per year, were extended in their current form for five years (through 2017).

The act also extended the American Opportunity Tax Credit through 2017, after which it reverts to the Hope Scholarship Credit. Currently, the credit enables families with college students to claim a credit of up to $2,500 annually for expenses (including tuition, fees, and books) for up to four years. Eligibility phases out for individual taxpayers with modified AGIs between $80,000 and $90,000 ($160,000 and $180,000 for married joint filers).

Most Estates Exempted

The $5 million individual exemption for federal estate and gift taxes (indexed annually for inflation) was retained. This increases the exemption from $5.12 million in 2012 to $5.25 million in 2013. However, the top tax rate on assets above the exempted amount rises from 35% to 40%. The exemption also remains portable, which means married couples may be able to combine their exemptions to help shield twice the level of assets.

Families can now begin to assess the changes and make more informed decisions about their household finances and investments. Of course, the law includes many pages of complex provisions on these and other important tax issues. Make sure you consult your tax professional before taking any specific action.

1) The Wall Street Journal, January 1, 2013

2) Internal Revenue Service, 2012

2) Internal Revenue Service, 2012

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2013 Emerald Connect, Inc.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.