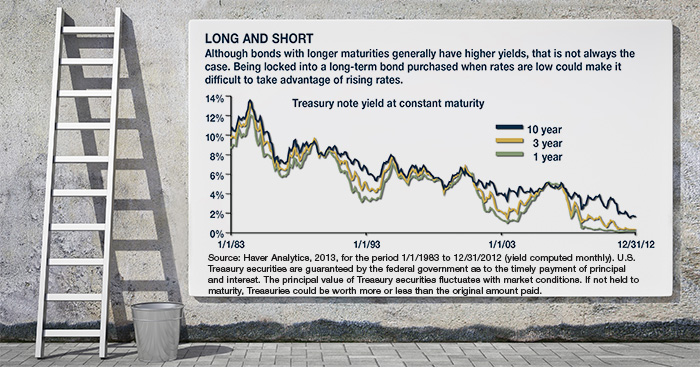

Short-term interest rates have been at historic lows for more than four years, due in large part to Federal Reserve policies intended to stimulate the economy.1 The Fed’s actions have also suppressed longer-term rates, leading to low yields on new-issue bonds of varying maturities (see chart).

Despite low rates, you might keep a portion of your assets in bonds or other fixed-income securities in order to balance more aggressive investments. And as you near retirement or progress through your retirement years, you may want to increase your bond holdings. This raises the question of how to keep an appropriate mix of bonds in your portfolio without tying up too much of your principal at low rates. Although no one can predict the future, rates are likely to rise over time, and some experts believe that when this happens the increase could be fairly rapid.²

Preparing for Change

One way to address fluctuating rates is to stagger the maturity dates of the bonds in your portfolio. This strategy, called a bond ladder, may help limit exposure to low interest rates while also increasing the likelihood that at least some principal may be available to reinvest when rates are rising.

One way to address fluctuating rates is to stagger the maturity dates of the bonds in your portfolio. This strategy, called a bond ladder, may help limit exposure to low interest rates while also increasing the likelihood that at least some principal may be available to reinvest when rates are rising.

You could create a ladder over a period of time by purchasing bonds of the same maturity every year or two. Alternatively, you could create a ladder during the same time period by purchasing new-issue bonds of different maturities or by purchasing bonds on the secondary market that are scheduled to mature in different years. For the latter strategy, you might purchase 10-year bonds scheduled to mature in 2016, 2018, 2020, and 2022.

Building a bond ladder is a form of diversification within the fixed-income portion of your portfolio, which in turn may be part of a broader asset allocation strategy. Of course, diversification and asset allocation do not guarantee against loss; they are methods used to help manage investment risk.

Building by Units

Although a bond ladder is often created by purchasing individual bonds, you could develop a similar and potentially more diversified strategy by purchasing unit investment trusts (UITs) with staggered termination dates. Bond-based UITs typically hold a varied portfolio of bonds with maturity dates that coincide with the trust termination date, at which point you could reinvest the proceeds as you wish. The UIT sponsor may offer investors the opportunity to roll over the proceeds to a new UIT, which typically incurs an additional sales charge.

Although a bond ladder is often created by purchasing individual bonds, you could develop a similar and potentially more diversified strategy by purchasing unit investment trusts (UITs) with staggered termination dates. Bond-based UITs typically hold a varied portfolio of bonds with maturity dates that coincide with the trust termination date, at which point you could reinvest the proceeds as you wish. The UIT sponsor may offer investors the opportunity to roll over the proceeds to a new UIT, which typically incurs an additional sales charge.

The return and principal value of bonds and UITs fluctuate with changes in market conditions. Bonds redeemed prior to maturity and UIT units, when sold, may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve a higher degree of risk. UITs may carry additional risks, including the potential for a downturn in the financial condition of the issuers of the underlying securities.

UITs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Federal Reserve, 2013

2) The Wall Street Journal, March 11, 2013

2) The Wall Street Journal, March 11, 2013

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Connect.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.