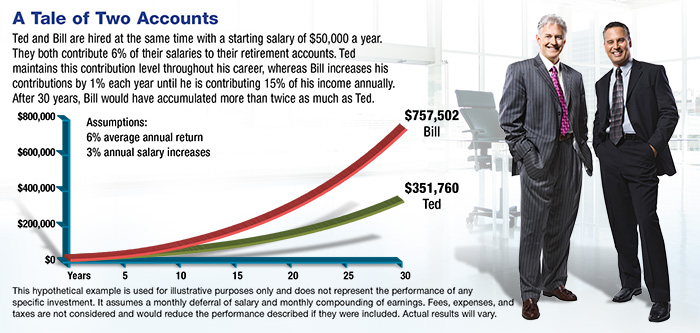

In a survey of workers who participate in an employer-sponsored retirement plan, 71% said they wanted their employers to increase their savings rate automatically by 1% each year.1 Some plans have auto-escalation features that increase workers’ contributions by a percentage point on an annual basis.2 Regardless of whether you save by default or by choice, increasing your retirement contributions could make a big difference in the amount you accumulate during your working years (see chart).

Although there’s nothing magical about a 1% annual increase, it may be a manageable way to get closer to an appropriate contribution level for your age and personal situation in Charleston SC, Miami FL, Charlotte NC or Atlanta GA. Industry estimates suggest that workers need to save 13% to 15% of salary throughout their careers in order to fund a retirement lifestyle equivalent to their pre-retirement standards of living.3 People who don’t start saving until later in life may have to save a higher percentage.

Here are a few suggestions that could help you save more without making major changes to your current lifestyle.

Save your raise. When you receive a raise, it’s tempting to increase your spending, but it’s also a great opportunity to increase your retirement savings. Even if you need some of the additional income for current expenses, you could divert a portion of it to your retirement account. And when you contribute on a pre-tax basis, the difference in your take-home pay may not be as significant as you might expect.

Make payments to your future. If you pay off the balance on a car loan, student loan, or credit card, you could continue making the same monthly payments directly to your retirement account. Because the payment is already part of your monthly budget, this provides a way to help increase your savings without a major change to your cash flow.

Pay as you go. Paying off a credit card may allow you to save more, but it might be wiser to avoid credit-card debt in the first place. Unless you pay off your balance in full each month, credit-card interest can grow quickly and could stand in the way of building the retirement savings you may need.

Limit the daily treats. You deserve an occasional treat, but spending on “little things” can add up over time. For example, if you stop for a $3.50 latte each day on your way to work and have another one in the afternoon, you would spend about $150 each month. If this amount was instead invested in an account earning a 6% annual return, you could accumulate more than $100,000 after 25 years.

This hypothetical example is used for illustrative purposes only and does not represent the performance of any specific investment. Fees, expenses, and taxes are not considered and would reduce the performance described if they were included. Actual results will vary.

Saving for retirement may seem daunting, but small steps could make a big difference for your financial future.

1) AdvisorOne.com, January 17, 2013

2) Defined Contribution Institutional Investment Association, 2013

3) Employee Benefit News, May 7, 2013

2) Defined Contribution Institutional Investment Association, 2013

3) Employee Benefit News, May 7, 2013

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.

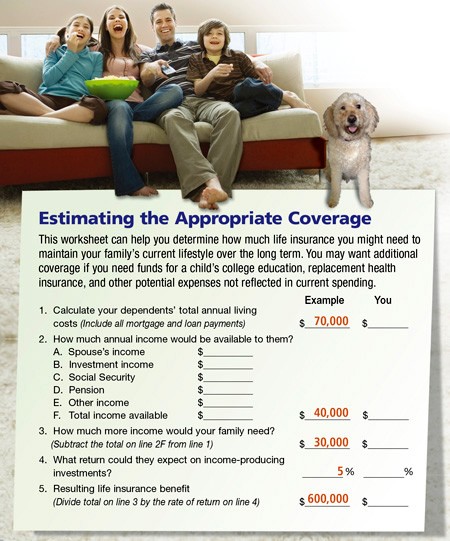

In order to do this, you estimate an average annual rate of return that might be achieved if the death benefit amount were invested in income-producing financial vehicles, without reducing the principal. For this example, a 5% rate of return is used. Of course, this rate of return is not representative of any specific investment; actual circumstances and results will vary.

In order to do this, you estimate an average annual rate of return that might be achieved if the death benefit amount were invested in income-producing financial vehicles, without reducing the principal. For this example, a 5% rate of return is used. Of course, this rate of return is not representative of any specific investment; actual circumstances and results will vary.