Trusts have often been used to help protect assets from estate taxes, but fewer estates are subject to federal estate taxation since the exemption rose to $5 million in 2010 with annual inflation adjustments. (The 2014 exemption is $5.34 million, or $10.68 million for married couples.) Even so, a trust can offer other benefits, such as sparing heirs the time-consuming and costly probate process and protecting assets so they will be distributed according to your wishes.

Legal Control of Assets

A trust is a legal arrangement under which one person or institution controls property given by another person for the benefit of a third party. The person giving the property is referred to as the trustor (orgrantor), the person controlling the property is the trustee, and the person for whom the trust operates is the beneficiary. With some trusts, you can name yourself as the trustor, the trustee, and the beneficiary.

A trust is a legal arrangement under which one person or institution controls property given by another person for the benefit of a third party. The person giving the property is referred to as the trustor (orgrantor), the person controlling the property is the trustee, and the person for whom the trust operates is the beneficiary. With some trusts, you can name yourself as the trustor, the trustee, and the beneficiary.

Although you may be hesitant to give up control of your assets, in some cases it may be worthwhile to choose an independent trustee who would be subject to strict legal requirements in administering the trust.

Testamentary vs. Living Trusts

A testamentary trust becomes effective upon your death and is usually established by your last will and testament. It enables you to control the distribution of your estate, including the opportunity to name a guardian for minor children’s assets, but does not avoid probate.

A testamentary trust becomes effective upon your death and is usually established by your last will and testament. It enables you to control the distribution of your estate, including the opportunity to name a guardian for minor children’s assets, but does not avoid probate.

A living trust takes effect during your lifetime. When you set up a living trust, you transfer the title of all the assets you wish to place in the trust from you as an individual to the trust. Technically, you no longer own the transferred assets. If you name yourself as trustee, you maintain full control of the assets and can buy, sell, or give them away as you see fit. However, this option may negate any estate tax benefits.

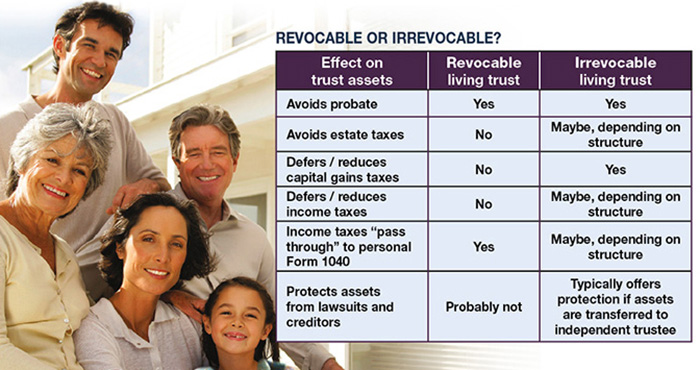

Living trusts can be revocable or irrevocable. A revocable trust can be dissolved or amended at any time while the grantor is still alive. An irrevocable trust, on the other hand, is extremely difficult to modify or revoke (and is subject to state law). (By definition, testamentary trusts are always irrevocable.) See the chart for a comparison of these two kinds of trusts.

Other Types of Trusts

A variety of other properly executed trusts could be used to meet specific needs. Here are four of the most common:

A variety of other properly executed trusts could be used to meet specific needs. Here are four of the most common:

- Charitable trust: Enables you to provide a charitable organization with a regular income for a set period or a lump sum at the end of the period.

- Incentive trust: Makes the transfer of assets to heirs contingent on their meeting goals or expectations, such as attaining higher education or starting a family.

- Supplemental or special-needs trust: Can help provide for a disabled child and may ensure that the child qualifies for government assistance programs.

- Life insurance trust: Helps ensure that the proceeds of a life insurance policy are excluded from your estate.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a life insurance strategy, it would be prudent to make sure you are insurable.

There are costs and expenses associated with the creation of a trust. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax advisors before implementing such strategies.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.