As with any purchase, it would be wise to learn more about a stock before investing. Because no one has a crystal ball, the price-to-earnings (P/E) ratio can be a helpful tool.

Underlying Value

On its surface, the P/E ratio is a simple calculation derived by dividing a stock's current price per share by the company's earnings per share over a 12-month period. You might consider it a measure of underlying value that indicates what investors are willing to pay for one dollar of earnings. For example, a P/E of 17 means an investor would pay $17 for every $1 the company earns. By this standard, a stock with a P/E of 27 could be considered more "expensive" than the stock with a P/E of 17, regardless of the share price.

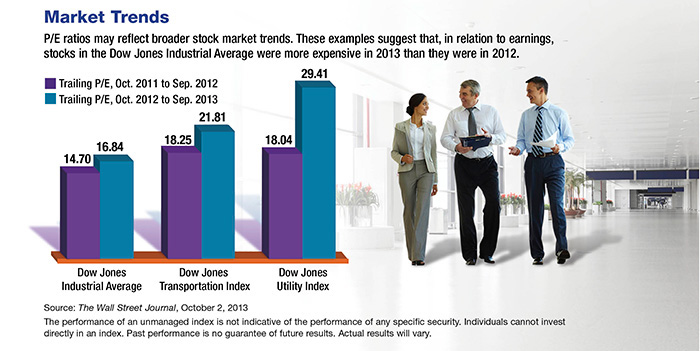

Earnings can be measured accurately only in the past, but investors are typically more interested in future potential. So there are two types of P/E ratios. The most commonly referenced is the trailing P/E, based on the officially reported earnings per share for the previous 12 months (abbreviated ttm for trailing 12 months). The forward P/E uses projected earnings over the next 12 months, based on information released by the company. Of course, the actual earnings could turn out to be very different from the projection.

Investor Perception

The P/E ratio may also reflect a general feeling among investors about a company's future. A high P/E might suggest that investors believe a company is poised to grow, and thus they are willing to pay more for the stock. A lower P/E could indicate that a company's earnings are considered stable and predictable, in which case investors may not be willing to pay as much for future earnings.

Of course, if the company does not perform as expected, the price and the P/E could change quickly. Viewing the P/E ratio in this light may help determine the role a stock might play in your portfolio, whether as a potential growth stock, a more stable investment, or something in between. The return and principal value of stocks fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost.

Different industries tend to have different P/E ratios, so it is generally not helpful to compare P/E ratios for stocks of companies in substantially different industries. More meaningful P/E comparisons assess companies in the same industry, one company against the industry average, or a company's current and past performance. A change in a company's P/E could be caused by an unexpected increase or decrease in earnings or a sudden shift in investor confidence.

Examining P/E ratios may help you become a more informed investor. Keep in mind that the potential value of an investment depends on multiple factors, and a decision to buy or sell should be based on your overall investment strategy.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.