The saying, “Give credit where credit is due,” should apply to personal finance, but sometimes the decision to extend credit is based on a single number: your credit score. Having a high score not only could make it easier to obtain credit but might reduce the interest rate you pay. It may also affect other financial transactions such as renting a home or buying insurance coverage in Charleston SC, Charlotte NC, Miami FL or Atlanta GA.

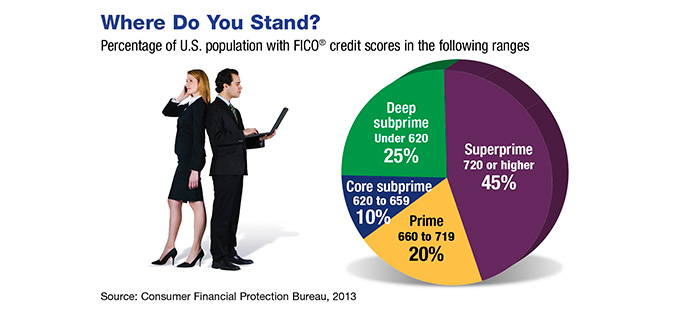

The most common credit score is based on software developed by Fair Isaac Corporation (FICO®) and expressed as a three-digit number ranging from 300 to 850 (see chart). The score is derived from a formula using five weighted components: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and types of credit in use (10%).1

Here are some tips that could help you maintain or potentially improve your score.

- Use at least one major credit card regularly and pay your accounts on time. Setting up automatic payments could help avoid missed payments.

- If you do miss a payment, contact the lender and bring the account up to date as soon as possible.

- Keep balances low on credit cards and other revolving debt.

- Use older credit cards occasionally to keep them active. Closing them may actually hurt your score.

- Don’t open or close multiple accounts within a short period of time. Only open accounts you need.

- Monitor your credit report regularly.

You can order a free credit report annually from each of the three major consumer reporting agencies at annualcreditreport.com or by calling (877) 322-8228. You’ll usually have to pay to see your credit score. If you are turned down for credit or receive less-than-favorable terms, you have a right to receive your score for free from the lender with an explanation of how the determination was made.

If you find incorrect information on your credit report, contact the reporting agency in writing, provide copies of any corroborating documents, and ask for an investigation. For more information, see consumer.ftc.gov/articles/0155-free-credit-reports.

1) Fair Isaac Corporation, 2014

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.