Bernie Madoff became infamous for perpetrating what may be the biggest Ponzi scheme in history — costing unsuspecting investors more than $17.5 billion in principal and $47 billion in phony profits.1

In a classic Ponzi scheme, the person committing the fraud usually pays investors their returns with their own money or with money from other investors, instead of any actual investment profits. Such schemes are destined to fail because the payout to investors depends on steady inflows of money from new investors. Madoff was exposed as a fraud during the 2008 market downturn. When many of his investors wanted to pull their money out, he didn’t have the funds to pay them.

Still, Madoff is not alone in his willingness to trick people out of their life savings. Investment fraud losses of about $22 billion are reported annually.2

Whether dangling phantom riches or tailoring sales pitches to their targets, some criminals have a knack for drawing people into financial scams in SC, NC, FL and GA. Knowing what to look for could help you guard against the following types of investment fraud.

Pyramid Schemes

A Ponzi scheme is one type of pyramid scheme. Ponzi schemes usually center around a person or institution that serves as the hub for collecting and directing money, whereas pyramid schemes are so named because the few early investors at the top are paid by larger groups of recruited investors. Each level of recruits tries to persuade more people to join in order to recoup their investments. Pyramid schemes eventually collapse when it becomes impossible to convince enough new people to participate.

A Ponzi scheme is one type of pyramid scheme. Ponzi schemes usually center around a person or institution that serves as the hub for collecting and directing money, whereas pyramid schemes are so named because the few early investors at the top are paid by larger groups of recruited investors. Each level of recruits tries to persuade more people to join in order to recoup their investments. Pyramid schemes eventually collapse when it becomes impossible to convince enough new people to participate.

Pump and Dump

This type of scam typically uses emails or the Internet to offer hot stock tips and promises of instant riches. The stock is usually relatively worthless just prior to the scam. Thousands of people could be contacted in an attempt to artificially inflate the stock price. After the stock price climbs, the scammers sell their entire positions and stop promoting the stock. Without new buyers, the price plummets and many investors are left holding worthless stock.

This type of scam typically uses emails or the Internet to offer hot stock tips and promises of instant riches. The stock is usually relatively worthless just prior to the scam. Thousands of people could be contacted in an attempt to artificially inflate the stock price. After the stock price climbs, the scammers sell their entire positions and stop promoting the stock. Without new buyers, the price plummets and many investors are left holding worthless stock.

Fictitious Instruments

Prime bank notes or guarantees purport to offer investors extremely high yields in a relatively short period of time through access to bank notes from large international banks. Such investments don’t exist, and the scam artist usually just takes off with the money.

Prime bank notes or guarantees purport to offer investors extremely high yields in a relatively short period of time through access to bank notes from large international banks. Such investments don’t exist, and the scam artist usually just takes off with the money.

Affinity Fraud

Some investment scams target an identifiable group, such as religious or ethnic communities or the elderly. These scams play on the built-in trust that exists within these groups, and the scammer is often (or pretends to be) a member of the group.

Some investment scams target an identifiable group, such as religious or ethnic communities or the elderly. These scams play on the built-in trust that exists within these groups, and the scammer is often (or pretends to be) a member of the group.

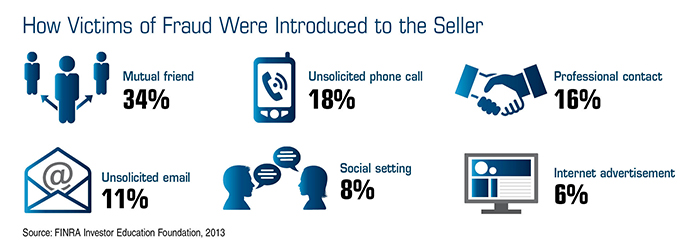

In fact, many victims of investment fraud say they met the seller through a mutual friend, which should serve as a warning not to trust someone simply because he or she is a member of the same professional group, religious group, or social circle that you are in.3 It’s important to investigate the facts and perform your own due diligence to determine whether a potential investment is suitable.

Also be wary of any unsolicited emails, high-pressure sales calls, and investment opportunities that “guarantee” outstanding profits or are touted as risk-free. Legitimate investments with the potential for higher returns typically involve greater risk.

Finally, remember that any investment should fit with your overall savings goals, risk tolerance, and time horizon.

1) Bloomberg, March 25, 2014

2) onwallstreet.com, March 21, 2014

3) FINRA Investor Education Foundation, 2013

2) onwallstreet.com, March 21, 2014

3) FINRA Investor Education Foundation, 2013

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Miami FL, Charleston SC, Atlanta GA, Charlotte NC - Tax, Financial Planning, Investments & Insurance.