More than half of Americans have direct investments in the stock market, and it’s probably safe to say that they would like their investments to grow.1Most investors would also like to believe their investments have value.

More than half of Americans have direct investments in the stock market, and it’s probably safe to say that they would like their investments to grow.1Most investors would also like to believe their investments have value.

So what does it mean to invest in a growth mutual fund or a value mutual fund? The labels “growth” and “value” reflect different investment approaches that mutual fund managers use when making portfolio decisions.

Two Strategies for Pursuing Results

Growth stocks are companies that appear poised to grow. These companies generally do not pay dividends because they are more likely to reinvest profits. A growth company may be on the verge of a market breakthrough or acquisition, or may occupy a strong position in a growing industry. Generally, smaller companies have more potential to grow, but a larger company may also be a growth stock. As you might expect, growth stocks carry substantial risk.

Value investing tries to identify companies that are undervalued by the market. Their stock prices may be lower in relation to their earnings, assets, or prospects. Established companies may be more likely to be considered value stocks than newer companies, and value stocks may pay dividends. When purchasing a value stock, the fund manager expects that the broader market may eventually recognize the value of the company, potentially causing the share price to rise. One of the risks is that a stock that is undervalued as a result of problems with the company or the industry may not be able to recover from the setback.

Many mutual funds that focus principally on value or growth stocks commonly have the word “value” or “growth” in the names. Blend mutual funds may include both types of stocks. The return and principal value of stocks and mutual funds fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost.

Historical Performance

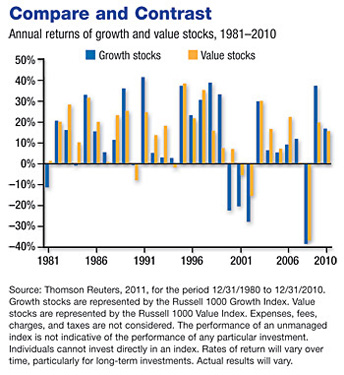

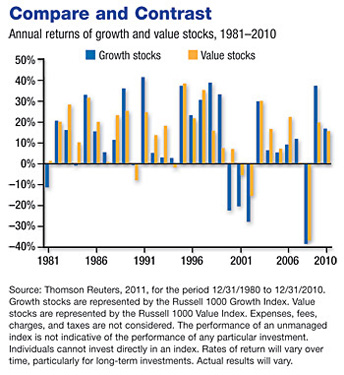

From 1981 to 2010, the average annual return for large-cap value stocks was about 2.1% higher than the average annual return for large-cap growth stocks. Yet growth stocks outperformed value stocks in 13 years of this 30 year period (see chart). Past performance is no guarantee of future results.

This suggests that holding both growth and value funds in your portfolio may help you take advantage of a variety of market conditions. We can help you determine whether growth or value investments — or both — may be appropriate for your portfolio.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Gallup, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2012 Emerald Connect, Inc.

Click here for more Newsletters. Thank you.

More than half of Americans have direct investments in the stock market, and it’s probably safe to say that they would like their investments to grow.1Most investors would also like to believe their investments have value.

More than half of Americans have direct investments in the stock market, and it’s probably safe to say that they would like their investments to grow.1Most investors would also like to believe their investments have value.