Typically, you have four choices, depending on the situation:

- Leave the funds in your former employer’s plan (if allowed)

- Roll the funds over to a new employer’s plan, if your new employer has a retirement plan and allows a rollover

- Roll the funds over to an IRA

- Take all or part of the funds as a cash distribution

Preserving Tax-Deferred Savings

Although each has advantages and disadvantages, the first three approaches generally preserve the tax-advantaged status of your retirement assets and offer the potential for continued tax-deferred growth.

Consider, however, that if you receive a check payable to you from your former employer’s plan, 20% will be withheld for federal income taxes. You have 60 days from the date of the check to roll over the entire distribution — including the tax withheld — to an IRA or a new employer-sponsored plan; otherwise, amounts not rolled over will be considered a taxable distribution.

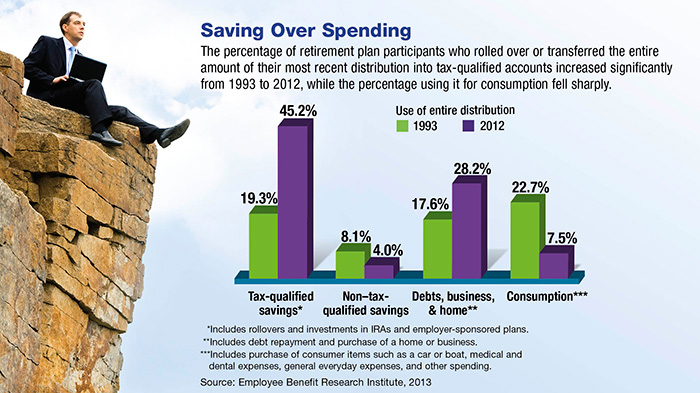

The fourth choice — a cash distribution — can be problematic. Although a quick infusion of cash may be appealing, it would be wise to proceed with caution before using a distribution for non–tax-advantaged purposes. Such a disbursement would be taxable as income, could be subject to a 10% early-withdrawal penalty, and might push you into a higher tax bracket. Moreover, by depleting your retirement account early, you might come up short when it’s time to retire.

Withdrawal Rules

Distributions from tax-deferred retirement plans [such as 401(k) and 403(b) plans] are taxed as ordinary income. Early withdrawals taken prior to age 59½ may be subject to a 10% federal income tax penalty, with certain exceptions such as the plan participant’s death, disability, or attainment of age 55 or older in the year of separation from service. (The age 55 exception does not apply to IRAs, annuity contracts, or modified endowment contracts.) You could also avoid the 10% penalty by taking a series of substantially equal periodic payments, based on life expectancy, that continue for at least five years or until age 59½,whichever occurs later.

1) MarketWatch, January 12, 2014

2) Employee Benefit Research Institute, 2013

3) CNNMoney, February 13, 2014

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Miami FL,

Charleston SC,

Atlanta GA,

Charlotte NC -

Tax, Financial Planning, Investments &

Insurance.

Connect and Read More About Us

Hedges Wealth Management LLC - A Registered Investment Adviser

Hedges Insurance Agency LLC

Tax, Financial Planning, Investments & Insurance Advisors

1300 Appling Drive #201 | Mt Pleasant | SC 29464

T +1 843 270 2534 | F 704 919 5946

If you are looking for more information on any subject in this Blog, please

Contact Us directly electronically or via phone. Thank you.