In July 2014, the U.S. Securities and Exchange Commission (SEC) adopted new regulations designed to help prevent “runs” on money market mutual funds.1Vulnerabilities in the money fund market were exposed during the 2008 financial crisis.

Crisis Control

Traditionally, money market funds have traded at a stable $1-per-share net asset value (NAV), even though the underlying holdings might be worth slightly more or less. However, there has never been a legal requirement that money managers must shield investors from losses.

In the fall of 2008, one large and long-established money fund “broke the buck” after suffering losses on corporate debt that caused its shares to fall to 97 cents. Investors fled and triggered a run on other money market funds that threatened to freeze corporate lending markets. To help limit the damage, the federal government intervened by providing a temporary backstop for all money market funds.2

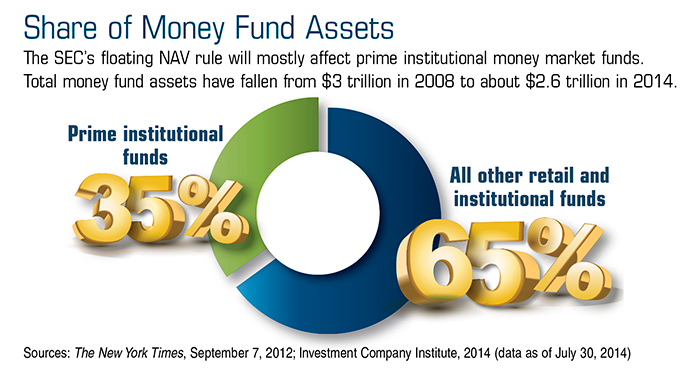

Among other SEC changes, “prime” institutional money market funds (utilized mainly by corporations, pensions, and other large institutions) will be required to float in value like other mutual funds. Institutional investors, which sold money market funds at a much greater rate than individuals during the crisis, will be expected to accept fluctuations

in value.3

Prime funds primarily invest in riskier short-term corporate debt, whereas nonprime funds invest only in securities issued by U.S.-based (state or federal) government entities. Thus, individual investors aren’t likely to be affected because retail funds sold to individuals will continue to trade at a stable $1 share price.

Limiting Liquidity

In addition, the SEC will allow all money market funds to place restrictions on redemptions in times of stress. A fund company’s board may impose a fee (up to 2%) on shareholders who redeem their shares, or may stop them from withdrawing money altogether for as many as 10 business days.4

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before you invest.

1, 3) The Wall Street Journal, July 23, 2014

2) USA Today, July 23, 2014

4) Reuters, July 23, 2014

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald Publications.

Click here for more Newsletters. Thank you.

Connect and Read More About Us

Hedges Wealth Management LLC - A Registered Investment Adviser

Hedges Insurance Agency LLC

Tax, Financial Planning, Investments & Insurance Advisors

1300 Appling Drive #201 | Mt Pleasant | SC 29464

T +1 843 270 2534

If you are looking for more information on any subject in this Blog, please

Contact Us directly electronically or via phone. Thank you.